Years of experience, hundreds of onsite due-diligence visits, and countless lessons learned from both successes and mistakes, help the Efficient team identify Managed Futures Traders across various CTA styles, strategies, and trading timeframes.

Using rigorous quantitative analysis and world class technology, Efficient relentlessly researches manager selection, portfolio construction, and risk management.

The results? Broadly diversified, well balanced, high quality global CTA access.

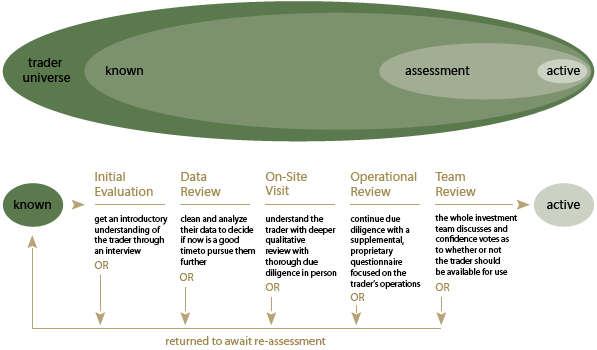

Efficient follows a disciplined manager selection process with a goal to know every CTA in the world. The process begins with, and is guided by, detailed quantitative analysis to evaluate consistent trader skill.

An extensive qualitative evaluation process is used to help the team identify great traders, from the full range of strategies, styles, and trading time frames.

Skill in building strong Managed Futures portfolios is a combination of years of business experience, deep knowledge of Managed Futures, insightful analytics and a determination to place investor's needs front and center. From the initial identification of investor needs and priorities, all the way through to designing customized risk reporting, Efficient serves as a trusted partner for those looking for the best possible way to access the benefits of Managed Futures.

Efficient invests through managed accounts exclusively which gives full transparency and control. Efficient utilizes proprietary automated systems to monitor positions of managers and portfolios on an intra-day basis – and an experienced risk team to evaluate and guide all responses.

Efficient employs third-parties for the funds in cash management, administration and audit, and has adopted best in class business processes, controls and systems to monitor and mitigate counterparty risk.

Information on this website is intended for use only by persons and entities that are "Qualified Eligible Persons" as defined in the Commodity Futures Trading Commision Regulation 4.7. Past results are not necessarily indicative of future results. Futures and options trading is extremely speculative and highly risky and is not suitable for all investors. There can be no assurance that an account or fund will earn any profits at all or will be able to avoid incurring substantial losses, including the entire loss of the investment.

This website is for informational purposes only and is not an offer to sell; a salutation of an offer to buy or a recommendation to buy any security. An investment is offered only on the basis of the appropriate Private Placement Memorandum and other offering documentation and in accordance with all applicable laws. This website does not describe all the various risks associated with investing in managed futures or foreign currency exchange, a list of which is in our fund offering documents and our completed due diligence questionnaires. We can provide these documents, or the list, to you upon request.

Pursuant to an exemption from the Commodities Futures Trading Commission in connection with accounts of qualified eligible persons, this document is not required to be, and has not been, filed with the commission. The Commodities Futures Trading Commission does not pass upon the merits of participating in a trading program or upon the adequacy or accuracy of commodity futures trading advisor disclosure. Consequently, the Commodities Futures Trading Commission has not reviewed or approved this trading program or any of the information on this website. Nothing contained in this website constitutes investment, legal or tax advice.

The Efficient logo, Efficient Capital® and Efficient Capital Management® are registered trademarks of Efficient Capital Management, LLC.